Real estate investing is one of the top options available to people around the country when looking at ways to build wealth. Purchasing a second home as an investment could offer you a new source of income, helping you to get one step further toward your goals. Today we’ll share some key things to consider when looking at real estate investment this year.

A Source of Passive Income

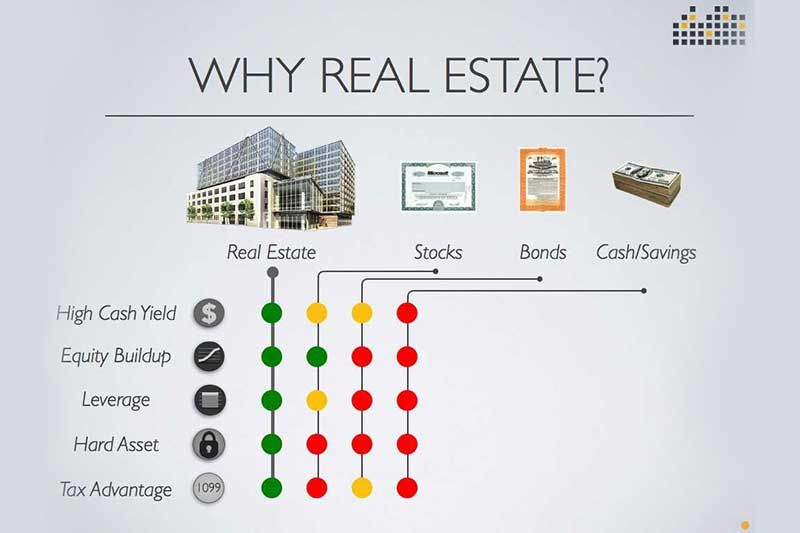

Although we’d all love to make more money, very few of us have the time or energy to take on a second job. Therefore, you need to look at ways to make money that don’t add too much pressure to your busy schedule. While there’s undoubtedly some initial work involved with real estate investment, you’ll find that you enjoy a steady cash flow and a source of passive income after that. Apart from regular maintenance and potentially managing short-term bookings, you’ll find that this is a much more profitable solution than other ways to make money.

Homes Appreciate Over Time

As well as making money in the short term, you’ll find that your home will appreciate as time goes on. Therefore, we recommend you consider real estate investment as a way to make money for decades. By entering into the investment for the long term, you’ll be able to make a good sum of money when you eventually sell your property. This can then be used for your retirement or invested in a new, more profitable rental property.

Tax Benefits

First-time real estate investors need to take the time to sit down and review their taxes. You’ll find that when you own a home, you rent out as a business, and you can write off various expenses yearly. These include the mortgage interest you pay, maintenance expenses, and depreciation. But, of course, you’ll need to work with a tax advisor to ensure you are writing off your costs correctly and to know that this is a beneficial solution for your financial future.

Feel More Secure Financially

The past year or two has put a lot of strain on our finances. Currently, we recommend that anyone looks at a way of making a second income, as you never know what tomorrow holds. A rental property can be a good backup for anyone worried about their finances. It could be the answer to paying for your child’s college education or retirement savings. You should never rely on one company or job to look after you for the rest of your life. In the future, you might even be able to retire from your current job and spend your days managing properties instead. Many people find this is something they are genuinely passionate about, and it’s an exciting opportunity for investors across the country.