Current Mortgage Rates 2025: What Your Sphere Thinks

Do you know what your sphere believes mortgage rates are right now? In Minneapolis and the Twin Cities, many think rates are stuck above 7%. In reality, 2025 rates have dropped nearly 1% from 2024 — and that’s your opportunity. (For a broader view of Minnesota housing trends, see our Minnesota Housing Market 2025 Year-End Update.)

More importantly: do you know how to inform your sphere so they see now as the right time to buy or sell? In this post, we’ll share the latest Minneapolis mortgage rate data, show marketing strategies tailored for your local market, and explain how ProfileTM helps you reach your clients and dominate your neighborhood in the final quarter of 2025.

Perception is everything. While the financial headlines often dominate national news, your clients’ decisions are shaped by what they think mortgage rates are — not just the actual number. This blog will share the latest rate stats, reveal strategies to inform your sphere, and explain how ProfileTM can help you market smarter to attract buyers and sellers before 2025 comes to a close. This update is part of our ongoing Monthly Market Stats for Minnesota real estate agents.

Why Perception of Rates Matters More Than Reality

Your neighbor may think rates are still “too high.” Meanwhile, your buyer lead may believe they’ve dropped dramatically.

Both perceptions influence behavior — often more than the real numbers.

Therefore, as a Minneapolis real estate agent, your role isn’t just to know current mortgage rates. It’s to bridge the gap between perception and reality.

By correcting misconceptions, you spark urgency, initiate conversations, and position yourself as the trusted advisor in the Twin Cities market.

Current Mortgage Rates in Minneapolis & Nationwide (September 2025)

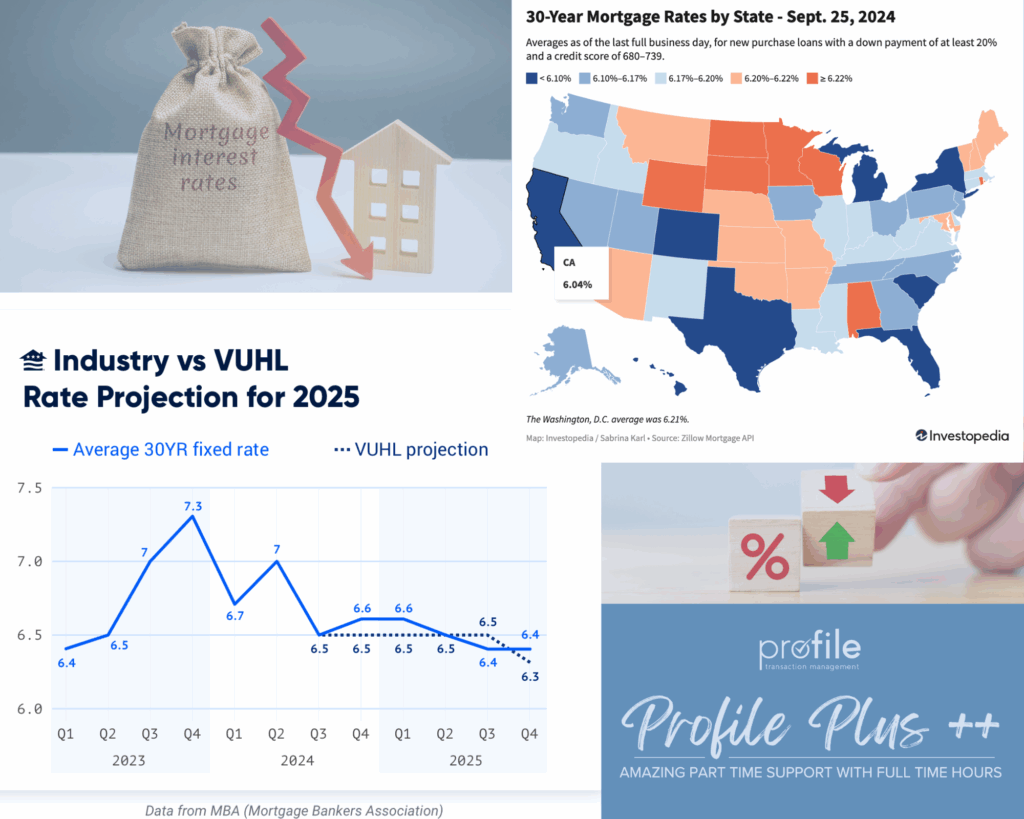

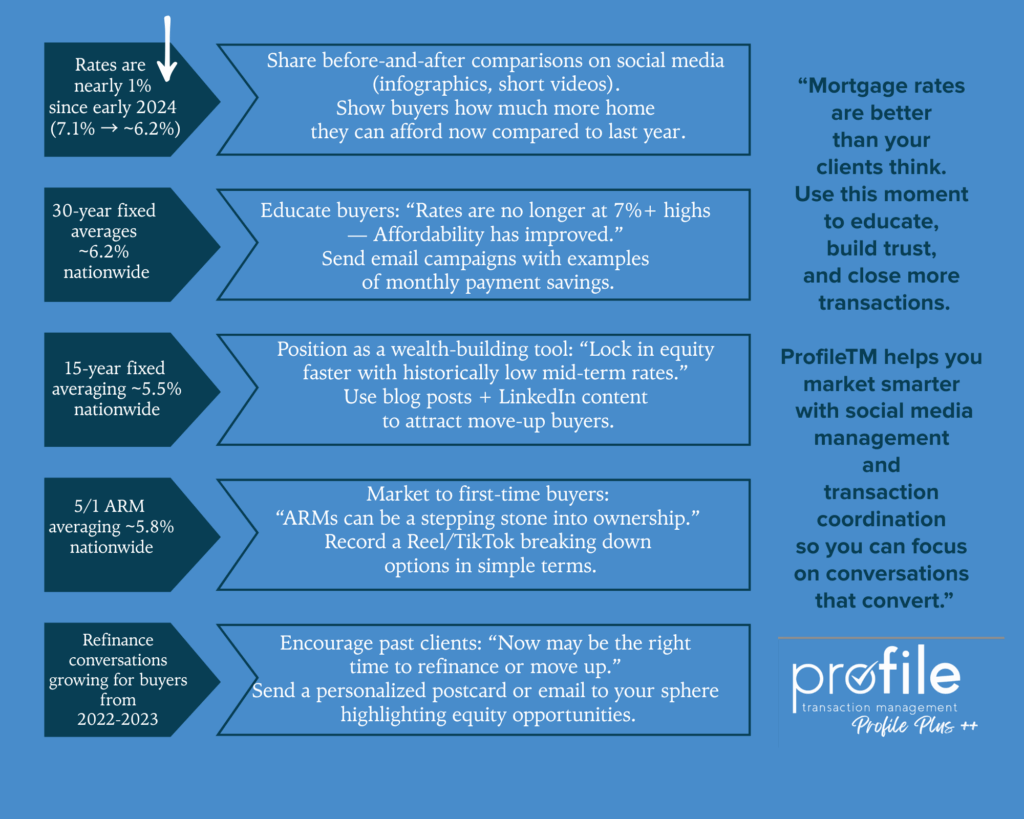

According to Freddie Mac, in September 2025 the 30-year fixed mortgage rate is averaging ~6.2% nationwide. For the Minneapolis real estate market, that drop represents nearly a 1% fall from early 2024.

In addition, 15-year fixed rates are averaging around 5.5%, while 5/1 ARMs hover near 5.8%. Therefore, even in a higher-rate environment, these shifts create conversation points you can use to reassure buyers and sellers.

Source: Freddie Mac, NAR, Inman

- 30-Year Fixed: ~6.2%

- 15-Year Fixed: ~5.5%

- 5/1 ARM: ~5.8%

(Source: Freddie Mac Primary Mortgage Market Survey, September 2025)

For example, in the Minneapolis real estate market, buyers are seeing average 30-year rates near 6.2%, down nearly 1% from 2024. These numbers are significantly better than where we stood last year, but many in your sphere may not realize rates have shifted. That’s your marketing opportunity.

💡 Stop wasting hours on social media and paperwork. ProfileTM helps you focus on clients while we handle the rest.

How Agents in Minneapolis Should Market to Their Sphere

In the Minnesota real estate market, buyers often hear national headlines, but your role is to localize the message for the Twin Cities housing market. Agents in the Twin Cities can use local stories (like buyers locking rates under 6%) to build urgency and trust. You don’t need to overwhelm your audience with charts. Instead, focus on bite-sized, clear messaging:

- “Rates have dropped by nearly 1% since last year — meaning buyers can afford more home today.”

- “Selling now means more buyers qualify, giving you stronger offers.”

- “Every 1% drop adds thousands of dollars to buyer affordability.”

Source: Freddie Mac, NAR, Inman

Social Media Strategies

- Post simple infographics comparing “last year vs this year” mortgage rates.

- Record a 60-second video explaining what buyers or sellers should know.

- Share local stories: “This week, 2 families in [Your City] locked in rates under 6%.”

Do they still think the rates are too high?

When mortgage rates are high, real estate agents need to shift the narrative away from fear and toward long-term opportunity, stability, and timing advantages.

Core Messaging for Buyers When Rates Are High

1. Marry the House, Date the Rate

- Remind buyers that they can refinance later when rates fall, but the right home may not be available again.

- Phrase: “You can change your rate, but you can’t change missing out on the perfect home.”

2. Equity Growth Doesn’t Wait

- Even with higher rates, home values in many areas are still appreciating.

- Waiting could mean paying more later — both in price and competition.

- Phrase: “Buy now, build equity, and refinance later — your future self will thank you.”

3. Rental Costs vs. Ownership

- Compare current mortgage payments with rising rents.

- Often, the difference is smaller than buyers think, especially once tax benefits are factored in.

- Phrase: “Why keep paying your landlord’s mortgage when you could be building your own wealth?”

4. Negotiation Power is Stronger in High-Rate Markets

- Fewer buyers = less competition = more room to negotiate.

- Buyers may secure seller concessions, price reductions, or rate buydowns.

- Phrase: “High rates mean you have more leverage at the negotiation table.”

5. Creative Financing Options

- Promote seller credits, 2-1 buydowns, adjustable-rate mortgages, and lender incentives.

- Phrase: “You have more financing options than you think — let’s find the best one together.”

Example Buyer-Facing Message (Agent to Client)

“Yes, rates are higher today, but that actually works in your favor. You’ll face less competition, more negotiating power, and the chance to secure the home you love without bidding wars. Plus, when rates eventually drop, you can refinance and lower your payment — while still enjoying the equity growth you started building today.”

Would you like a ready-to-use social media carousel script (post copy + slide text) so you can quickly educate buyers on this high-rate messaging?

ProfileTM’s social media management service helps you create and schedule these posts, saving you hours each week while maximizing engagement. ProfileTM Social Media Guide for Realtors in the Twin Cities.

📩 Schedule a call now to see how our TC and Profile Plus social media services can help you close more deals in 2025.

GEO-Focused Marketing: Neighborhood & Local Strategy

SEO and GEO optimization aren’t just for blogs. They work in your local market too. Here’s how to turn mortgage rate conversations into neighborhood-specific marketing campaigns:

- Neighborhood Market Updates – Share rate news paired with local housing stats.

- Geo-Farming Flyers – Use print and digital ads targeted by ZIP code.

- Local Facebook Ads – Target “within 15 miles of [City]” to keep your brand top of mind.

- Sphere Email Campaigns – Use a subject line like: “Did you hear mortgage rates dropped in [City]?”

These strategies position you as the local expert, not just another agent sharing national headlines.

How ProfileTM Helps Agents Win in 2025

At ProfileTM, we help real estate professionals like you do two things exceptionally well:

- Transaction Coordination (TC Services): We manage the paperwork, deadlines, and compliance so you don’t have to. Therefore, you can stay in front of your clients instead of being buried in admin tasks.

- Profile Plus Social Media Management: We create, design, and schedule content that educates your sphere on timely topics — like mortgage rates — and builds trust through consistent visibility. In addition, we tailor posts to highlight what’s happening in your local Minneapolis or Twin Cities market, so your brand stays top of mind.

By partnering with ProfileTM, you’ll free up valuable time while amplifying your reach. Most importantly, you won’t just know the numbers — you’ll use them to spark conversations, attract new leads, and close more deals.

Ready to leverage support that helps you win in 2025? Learn more about our Transaction Coordination Services and Profile Plus Social Media Packages.

Final Thoughts: Closing Out 2025 Strong

The last quarter of the year is where agents can either coast or crush their goals. By sharing clear, local insights on current mortgage rates, you’ll spark urgency, attract more buyers and sellers, and position yourself as the trusted advisor in the Minneapolis and Twin Cities real estate market.

Most importantly, your clients need to hear that now is the right time to act. Rates have improved since 2024, affordability has increased, and competition is less intense. Therefore, you can help them make confident decisions before 2025 ends.

If you’re a Minneapolis Realtor — or serving clients anywhere nationwide — ProfileTM gives you the leverage to stay focused on relationships and closings. With our Transaction Coordination services and Profile Plus Social Media management, you’ll free up your time, market smarter, and set up a strong pipeline heading into 2026.

👉 Ready to market smarter? Schedule a call with ProfileTM today and let’s finish 2025 strong.

Need a Transaction Coordinator?

Stop stressing over contracts and compliance. ProFileTM is a trusted transaction coordination company helping real estate agents nationwide close deals smoothly. Our professional transaction coordinators handle deadlines, communication, and file management — so you can focus on clients.

👉 Learn more about our transaction coordination services »

You can style this in a shaded box, pull-quote, or sidebar widget so it stands out visually on your blogs.

Author Bio: Written by Kelly Zwilling, Founder of ProfileTM — a trusted national partner providing transaction coordination, social media management, and leverage systems to help Realtors grow their business without the stress.