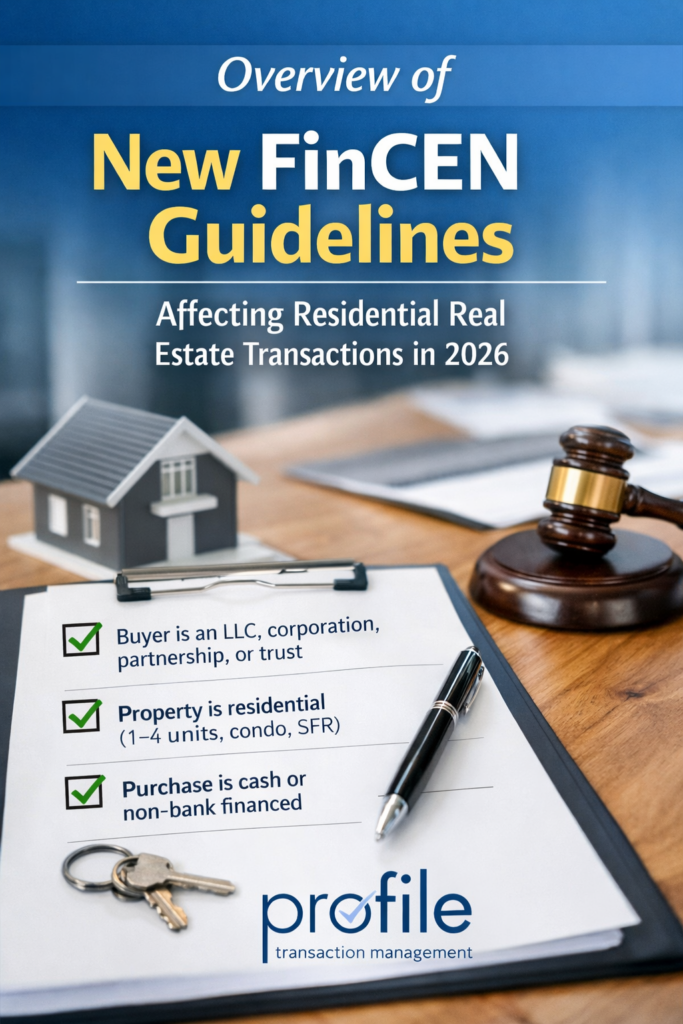

New FinCEN Guidelines are federal reporting rules that change procedures for certain residential real estate closings, effective March 1, 2026. The point is simple: when a non-financed residential property transfer involves a legal entity or trust, FinCEN requires a report that identifies the parties and the beneficial owners behind the buyer. This rule applies nationwide, including Minnesota, Tennessee, and Florida, because it is federal. FinCEN

For agents, this matters because investor transactions often use LLCs, corporations, partnerships, and trusts. As a result, these deals are more likely to involve federal reporting requirements. In practice, this structure increases the likelihood that a transaction will trigger reporting under the New FinCEN Guidelines. Those are the exact patterns that can trigger reporting. If your deal becomes reportable late in the process, you can see closing delays, last-minute document requests, or buyers who feel “surprised” by compliance steps.

FinCEN handout provided by Great North Title

This article explains the rule in a definition-first format, shows when reporting applies, and gives a practical checklist so your investor clients are ready.

New FinCEN Guidelines: When a Residential Real Estate Report Is Required and What Agents Must Do

What the FinCEN residential real estate rule means for agents

Definition: Under the New FinCEN Guidelines, FinCEN requires a Residential Real Estate Report for certain non-financed transfers of residential real estate when the buyer is a legal entity or trust. Residential real estate, when the buyer is a legal entity or a trust (not an individual buying in their own name). The reporting person involved in the closing or settlement process submits the report to FinCEN. FinCEN by the reporting person involved in the closing or settlement process.

In practice, the rule aims to reduce anonymous ownership in high-risk deal types by requiring disclosure of:

- The reporting person and transaction details

- The transferee entity or transferee trust

- Beneficial owners of the buying entity or trust

- Certain individuals who sign closing documents on behalf of the entity/trust

Why investors feel this first: investors commonly buy with entities for liability protection, partnership structures, or asset management. That structure can convert a normal closing into a reportable closing.

When a residential real estate transaction becomes reportable

Use this quick test to identify a reportable transaction. Under the New FinCEN Guidelines, a residential real estate transfer becomes reportable only when specific conditions exist.

In general, reporting applies when the closing occurs on or after March 1, 2026, the buyer is a legal entity or trust rather than an individual, the transaction involves residential real estate, and the purchase is non-financed, such as a cash transaction.

- Closing date is March 1, 2026, or later

- Buyer is not an individual (for example: LLC, corporation, partnership, or trust)

- Property is residential real estate (commonly 1–4 family)

- Transaction is non-financed (cash or private/non-institutional financing).

Why do investor transactions trigger federal reporting more often

This matches the plain-language summary that many title teams are already sharing: reportable deals are often cash-investor purchases made through entities or trusts after March 1, 2026.

What “non-financed” means:

If the purchase is financed by a traditional institutional lender with standard compliance obligations, it is typically not treated as “non-financed” for this reporting framework. Cash and many private financing structures are the common triggers.

What “residential real estate” means:

The rule is targeted at residential transfers. If you work with investor clients who buy 1–4 unit properties, single-family rentals, condos, or similar residential assets, assume the property type may qualify and confirm early.

When federal real estate reporting does not apply

Here are common exclusions agents should know. The simplest “does not apply” scenarios that show up in day-to-day agent work include:

- Individual buyer in their own name (not an entity or trust)

- Traditional institutional financing is used

- Closing occurs before March 1, 2026

That said, investor transactions can change midstream. For example, a buyer may begin as an individual and later switch to an entity. For example, a buyer may start as an individual and later switch to an LLC. A buyer may start as an individual and later switch to an LLC. Financing can also change if a lender falls through and the buyer pivots to cash. Those changes can turn a non-reportable deal into a reportable one late in escrow, when delays are common.

Agent takeaway: Confirm the buyer’s vesting and financing plan early, then reconfirm after inspection and again when closing is scheduled. That reduces last-minute compliance friction.

Who files the FinCEN real estate report, and how the timeline works

Real estate agents are usually not the filer. The reporting responsibility generally sits with a closing or settlement professional identified as the reporting person. In practice, the reporting person collects the required information and submits the report to FinCEN. FinCEN’s rule framework requires certain professionals involved in closings and settlements to submit the report for covered transfers.

In practice, many title company summaries state this plainly: the title or settlement agent is the reporting party. They collect beneficial ownership information from the buyer entity.

Filing deadline (important): For reportable transfers, the report must be filed by the later of:

- 30 days after closing, or

- The final day of the month following the month of closing, FinCEN Fact Sheet

Why this matters to agents: You may get post-acceptance or pre-close requests for entity documents and beneficial ownership details so the reporting person can file on time.

What agents should collect from investor clients to prevent delays

Practical Checklist: Importantly, agents should not provide legal advice. However, you can prevent surprises by using a neutral, process-focused checklist.

If a deal might trigger the New FinCEN Guidelines, encourage the buyer to prepare entity information early. This includes confirming how the buyer will take title and whether financing terms could change before closing.

By preparing in advance, the reporting party can verify beneficial ownership details without slowing the transaction. As a result, compliance-related requests are handled earlier and closing timelines remain intact.

Common information requested for FinCEN compliance

Information commonly requested by title and settlement teams:

- Exact buyer name and type (LLC, corporation, partnership, trust)

- Formation state and governing documents (operating agreement, trust documents, or equivalent)

- Authorized signers for closing documents

- Beneficial owner details requested by the reporting person (often identity and control/ownership information)

- Clear financing description (cash, hard money, private note, institutional loan)

- Target closing date and whether it could move past March 1, 2026

Why this works: When the reporting person can verify the entity/trust structure and identify beneficial owners early, they reduce the chance of a compliance scramble during the final week.

Important note for investors who have already completed other federal reporting: Some transaction summaries emphasize that this real estate reporting requirement is separate from the Corporate Transparency Act beneficial ownership reporting. In other words, an investor may have filed BOI elsewhere and still need to provide information again for a covered real estate closing.

How to explain the New FinCEN Guidelines to investor buyers

Use a short explanation that is factual and calm in plain language:

- “This is a new federal reporting rule for certain residential purchases.”

- “It mainly impacts cash or non-bank financed deals when the buyer is an LLC or trust.”

- “The title/settlement side files the report, but they may need entity and beneficial owner details from the buyer.”

- “If we prepare early, the closing timeline stays smooth.”

That approach positions you as an educator and guide without stepping outside your lane.

How a transaction coordinator supports FinCEN-related transactions

A transaction coordinator supports FinCEN-related transactions by identifying early whether a deal may trigger federal reporting and helping keep the file organized once compliance steps are required. While they do not file the FinCEN report, transaction coordinators help confirm buyer vesting, track financing structure changes, and coordinate information requests between all parties. As a result, agents, buyers, and settlement professionals stay aligned, and investor transactions are far less likely to experience last-minute delays.

What changes for agents in Minnesota, Tennessee, and Florida

Because the New FinCEN Guidelines are federal, the core rule applies across the U.S. Therefore, agents in Minnesota, Tennessee, and Florida follow the same baseline requirements. Therefore, agents in Minnesota, Tennessee, and Florida follow the same baseline requirements. The difference is not the law itself. The difference is operational:

- Different title companies and closing attorneys may request information in slightly different formats.

- Investor-heavy markets may see more frequent reportable scenarios.

- Buyers who invest across states may assume their “usual” process transfers cleanly, when local settlement practices can vary.

Your best move is consistent everywhere: identify likely reportable deals early, set expectations, and keep the reporting person unblocked.

If your 2026 pipeline includes investor clients, you do not want FinCEN reporting to become a last-minute fire drill. The best workflow is proactive: flag likely reportable deals early, coordinate with the reporting person, and keep the file moving.

Book a call to build a repeatable transaction workflow that supports investor deals in Minnesota, Tennessee, and Florida, and keeps compliance-driven requests from slowing down closing.

FAQs about New FinCEN Guidelines

Common questions about FinCEN real estate reporting

New FinCEN Guidelines are federal reporting requirements that require a Residential Real Estate Report for certain non-financed transfers of residential real estate to legal entities or trusts, starting March 1, 2026.

The Residential Real Estate Rule, as described by FinCEN, is set to take effect on March 1, 2026.

Common triggers include cash (or non-bank-financed) residential purchases involving the buyer as an LLC, corporation, partnership, or trust.

Reporting deadlines and geographic scope

FinCEN places reporting duties on certain professionals involved in real estate closings and settlements for covered transfers. In many transactions, the title or settlement side acts as the reporting party. FinCEN

A transaction coordinator helps identify early whether a deal may fall under the New FinCEN Guidelines and coordinate with the reporting party to prevent delays. While a transaction coordinator does not file the FinCEN report, they help organize entity information, confirm buyer vesting and financing structure, and track compliance-related deadlines tied to the closing.

In addition, a transaction coordinator acts as a central point of communication between the agent, buyer, title company, and settlement professionals. As a result, title and settlement teams request required documents and disclosures earlier in the process, reducing last-minute issues and protecting the closing timeline for investor transactions between the agent, buyer, and settlement professionals to keep the transaction on schedule.

For reportable transfers, FinCEN’s filing instructions and fact sheet state the report is due by the later of 30 days after closing or the last day of the month following the month of closing.

Yes. The rule is federal, so it applies nationwide, including Minnesota, Tennessee, and Florida.