Welcome, Agents & Partners

As your trusted source for real estate insight and leverage strategies, ProfileTM brings you the Minneapolis mortgage market update for transaction coordinators September 2025. This month’s report breaks down the latest Minnesota housing data, mortgage rate trends, and what they mean for your clients and closings. (For a broader view of Minnesota housing trends, see our Minnesota Housing Market 2025 Year-End Update.)

Rates are falling, sales are rising, and momentum is shifting back toward balance. Here’s how to stay ahead and leverage ProfileTM’s Transaction Coordination and Profile Plus services to maximize your fall market success.

Minneapolis Market Update – September 2025 Mortgage Snapshot

October 16, 2025

Rates have declined steadily since June, when they averaged 6.82%. Now near 6.35%, they’re at their lowest point of the year — creating new opportunities for buyers and agents following this Minneapolis mortgage market update for transaction coordinators September 2025.

| Loan Program | Interest Rate | APR |

|---|---|---|

| Conventional (5% Down) | 6.35% | 6.42% |

| FHA (3.5% Down) | 6.15% | 6.28% |

| VA (Zero Down) | 6.05% | 6.12% |

| Conventional Special | 6.10% | 6.22% |

| Jumbo (25% Down) | 6.50% | 6.57% |

Rates have declined steadily since June, when they averaged 6.82%. Now near 6.35%, they’re at their lowest point of the year — creating new opportunities for buyers previously priced out.

Assumptions: 30-year fixed rate, 720+ credit score, owner-occupied primary residence.

Rates courtesy of Guild Mortgage, as of October 16, 2025.

Betsy Lowther Branch Manager NMLS #222188

Guild Mortgage | Company NMLS #3274

Find the loan to fit your life Select from hundreds of loan products tailored to your needs

5780 Lincoln Drive Ste 151 Edina, MN 55436

Equal Housing Opportunity

States licensed in: FL, MN, WI

Website Apply Online

Fresh Market Trends – Minneapolis Market Update Septemeber 2025

According to Minnesota REALTORS® and Minneapolis Area REALTORS®, home sales climbed as rates fell this September:

- New listings: ↑ 4.9% statewide | ↑ 5.2% Twin Cities metro

- Pending sales: ↑ 5.9% statewide | ↑ 7.9% metro

- Median sales price: ↑ 2.1% statewide ($357,200) | ↑ 2.6% metro ($390,000)

Buyers and sellers are both re-entering the market, with 54% of Minnesota counties showing new listing growth and nearly 59% posting more sales year-over-year.

Even with a small uptick in inventory, both the state and metro remain undersupplied — just 3.2 months statewide and 2.7 months metro, below the 5–6 months that define a balanced market.

➡️ Takeaway: Improved affordability and rate cuts could make Q4 a strong finish for agents positioned with leverage and marketing systems in place.

Local Insights from NorthStarMLS- Minneapolis Market Update

September 2025

Homes in the metro spent an average of 44 days on market, up 12.8% from last year, with sellers receiving 98.4% of list price.

Pro Tip for Agents:

These numbers reveal opportunity. As activity diversifies across price points, luxury and mid-tier homes are gaining traction. Use this time to strengthen your buyer pipeline and rely on your TC for compliance and contract deadlines so you can focus on relationship-building.

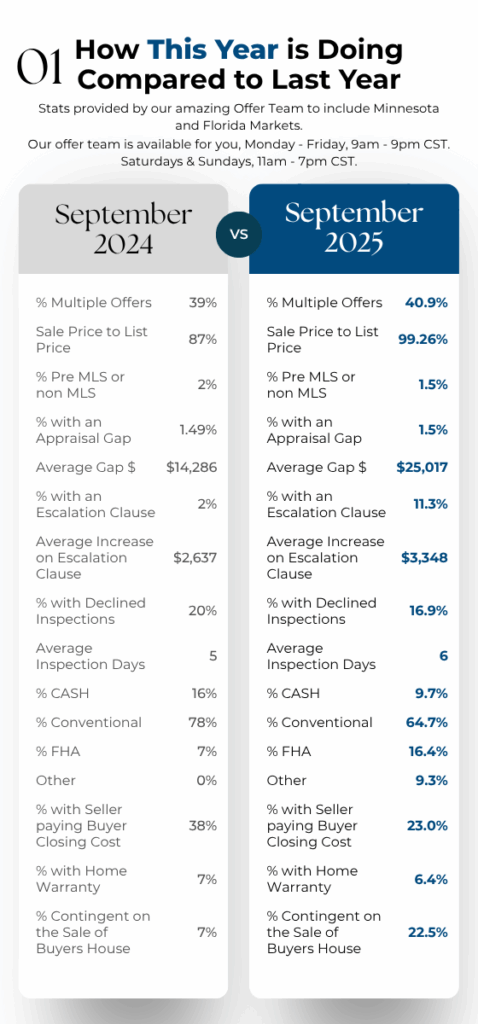

Updated Offer Stats from ProfileTM

Why Transaction Coordination Matters

When markets move fast, agents need leverage to keep up. Transaction Coordinators (TCs) at ProfileTM give you that advantage:

- Save Time: We handle deadlines, compliance, and paperwork.

- Win More Clients: You stay available for showings, negotiations, and lead generation.

- Scale Seamlessly: Whether you close 5 or 50 transactions, our systems adapt with you.

ProfileTM TCs are Minnesota-based professionals who understand local compliance, MLS standards, and contract timelines — helping you close with confidence.

Profile Plus Advantage

The fall 2025 Minneapolis mortgage market update highlights how better rates and growing inventory give agents more leverage — and ProfileTM helps you make the most of it. This update is part of our ongoing Monthly Market Stats for Minnesota real estate agents.

Take your leverage further with Profile Plus, our on-demand support suite for agents and teams.

Social Media Management: Stay visible online with weekly branded content.

QuickBooks Support: Simplify bookkeeping and expense tracking.

Database Management: Keep your CRM active, clean, and converting.

ProfileTM is your all-in-one growth partner, helping you protect your profit margins and your peace of mind — even as markets shift.

Ready to turn this market momentum into growth?

Partner with ProfileTM for Transaction Coordination and Profile Plus support — your leverage solution in every market.

👉 Learn more about ProfileTM services

FAQ

Rates are averaging 6.35% for conventional loans, with FHA and VA products slightly lower.

By managing deadlines, documents, and compliance, TCs free agents to focus on negotiations and clients.

A suite of on-demand business services — including social media, QuickBooks, and database management — designed to help agents grow sustainably.

Need a Transaction Coordinator?

Stop stressing over contracts and compliance. ProFileTM is a trusted transaction coordination company helping real estate agents nationwide close deals smoothly. Our professional transaction coordinators handle deadlines, communication, and file management — so you can focus on clients.

Learn more about our transaction coordination services.»

Learn more about our transaction coordination services.»

Written by Kelly Zwilling About.me, Founder & Lead Transaction Systems Strategist at ProfileTM. With 20+ years in real estate operations and national TC management, Kelly helps agents grow sustainable, balanced businesses. LinkedIn